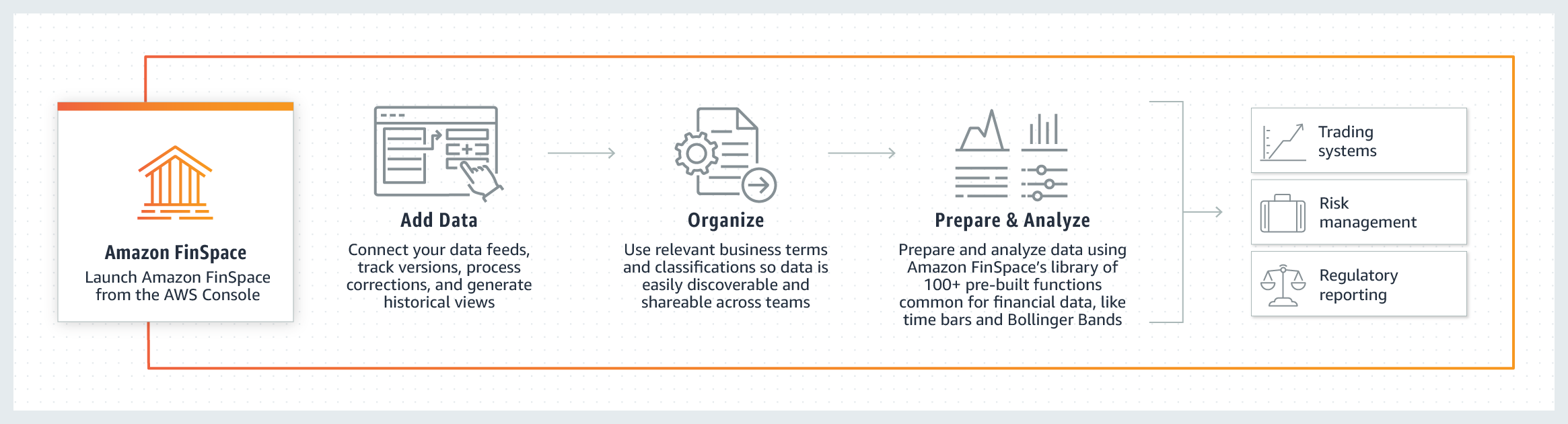

Recently, AWS announced a data management and analytics solution purpose-built for the Financial Services Industry (FSI) called Amazon FinSpace. The service aims to reduce the time it takes for financial analysts to find and access all types of financial data for analysis.

With the release of Amazon FinSpace, the company offers a managed service targeted for financial analysts at FSI companies such as hedge funds and asset management firms to allow them to store, catalog easily, and prepare financial data at scale. It facilitates running analysis on-demand across all accessible data, including internal sources such as order management systems, portfolio management systems, and third-party data like job statistics and earnings reports.

In an AWS press release on Amazon FinSpace, Saman Michael Far, VP of financial services technology at AWS, said:

FSI organizations generate and purchase massive amounts of data, but using this data is very difficult because of the time and effort it takes to collect and prepare data for analysis. Amazon FinSpace is a game-changer for FSI organizations. Amazon FinSpace radically reduces the time it takes for FSI customers to do analytics across petabytes of data, making it significantly easier for them to identify new sources of revenue, attract customers, and reduce cost and risk.

According to an AWS News blog post by Sébastien Stormacq, principal developer advocate at AWS Financial Analysts, it can benefit from a built-in library of more than 100 specialized functions for time series data and leverage integrated Jupyter notebooks to experiment with data – and parallelize these financial data transformations with dynamically scaled Spark clusters. Furthermore, they can leverage a framework included with FinSpace to manage data access and audit who is accessing what data and when - it tracks data usage and generates compliance and audit reports.

Source: https://docs.aws.amazon.com/finspace/latest/userguide/finspace-what-is.html

Besides AWS, its competitor Microsoft also offers financial service in the cloud. Microsoft Cloud for Financial Services is one of the new industry-specific cloud offerings, which brings together Microsoft solutions, unique templates, APIs and additional industry-specific standards, along with multi-layered security and compliance coverage.

Holger Mueller, principal analyst and vice president at Constellation Research Inc., told InfoQ:

The AWS Finspace offering signals two key trends in the market: On the one side, the push for vertical solutions remains string in 2021 - and likely beyond. On the other side, AWS is now creating more higher-level aggregate offerings - like the data and analytics management platform for financial services vendors. That shows the maturity of the AWS underlying services and the value of higher-level offerings. Instead of each financial service customer gluing together essential AWS services, AWS provides the combined offering.

In addition, Corey Quinn, chief cloud economist at the Duckbill Group, tweeted the following about Amazon FinSpace:

This is a fascinating release, just because it focuses so clearly on a specific industry segment (a vast and lucrative one, to be sure; if you haven't worked in this space, you'd be forgiven for underestimating it). This is very clearly targeted to some customers, not the rest.

Lastly, Amazon FinSpace is currently available in the US East (Northern Virginia), US East (Ohio), US West (Oregon), EU (Ireland), and Canada (Central) AWS regions. The pricing of FinSpace is based on the amount of data stored, users enabled, and the compute power used to process and analyze that data. The exact pricing details are available on the pricing page.